Public and Private Broadcasters across the World - The Race to the Top

Daniel Wilson

Head of UK Policy, Â鶹ԼÅÄ

Tagged with:

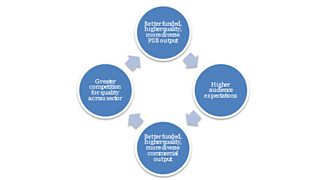

Last week, Â鶹ԼÅÄ Director General Tony Hall unveiled .Ìý He outlined that the Â鶹ԼÅÄ’s success didn’t come at the expense of others, describing a ‘virtuous circle’, stimulated by public funding.Ìý As illustrated below, when the Â鶹ԼÅÄ does well, others have to compete and raise their game, challenging the Â鶹ԼÅÄ to aim yet higher.

The UK’s competitive success depends on the Â鶹ԼÅÄ, receiving just 23% of TV revenues but accounting for 43% of UK spend on original programmes, but also on highly successful commercially funded players.Ìý This includes pay-TV providers like BSkyB who invest in quality content, and a unique model for delivering public service broadcasting beyond the Â鶹ԼÅÄ in the publicly-owned Channel 4, and commercial channels with public service obligations, ITV and Channel 5.

In the UK, we’ve long recognised the benefits of creative competition between the Â鶹ԼÅÄ and commercially funded broadcasters, whether over the Saturday night schedule or the latest crime drama series.Ìý Less examined has been how such competitive dynamics play out internationally, yet it is one of the best ways to test the virtuous cycle theory.Ìý

does just that.Ìý The analysis from Dr Jonathan Simon of Inflection Point looks at 14 markets across the globe and uses data from new and bespoke sources – with the UK as just one data point among many.Ìý It assesses the strength of both public and private provision judged by revenues, levels of investment in originations, diversity of schedule and audience perceptions of quality.

Its key finding is that where public service broadcasting is strong, commercial broadcasting is also strong.Ìý This is particularly evident in the Nordic countries, so feted for their drama success, Australia and the UK. The reverse is also true: where public broadcasters are weakened, such as in Portugal, the commercial sector is also weak.Ìý Statistically, the correlation is clear, positive and significant.Ìý

These findings do not just reflect market scale and wealth.Ìý These were controlled in the analysis and the findingsÌýremained statistically significant.Ìý Nor do the findings diminish the distinctiveness of public service broadcasting.Ìý On levels of investment, diversity and quality, public broadcasters tend to lead their markets, as warranted by their public revenues.ÌýPublic–private competition, the report suggests, helps ensure the sector’s economic success, complementing the findings of a series of reports on the Â鶹ԼÅÄ’s overall , its and, just last month, the value of its .Ìý

There are also creative and audience benefits.Ìý

The research suggests that public broadcasting can help avert the risk of lower standards and a ‘race to the bottom’ in increasingly competitive global markets.Ìý

Instead, strong public broadcasting spurs a ‘race to the top’ between public and commercial media, raising overall standards across the industry and leaving viewers better served by public service and commercial channels alike.Ìý

isÌýHead of International Policy, Â鶹ԼÅÄ

Ìý

- .

Ìý