We've updated our Privacy and Cookies Policy

We've made some important changes to our Privacy and Cookies Policy and we want you to know what this means for you and your data.

RBS court battle with investors adjourned

Image source, Reuters

Legal action brought by 9,000 investors who are seeking compensation from Royal Bank of Scotland after losing money on shares has been adjourned for 24 hours.

Investors say they were misled over the bank's financial health in the run-up to its near-collapse and Β£45bn government bailout in 2008.

They are demanding Β£520m from the bank and four former directors, including former RBS boss Fred Goodwin.

However, the bank has been trying to reach a last-minute settlement.

RBS has now offered the investors 82p a share, almost double its previous offer.

The bank is keen to forestall the case at London's High Court, had been due to open on Monday morning and was expected to last 14 weeks.

The adjournment, which was agreed by the claimants and the defendants, was granted at a brief hearing by Mr Justice Hildyard.

He was told by Jonathan Nash QC, for the shareholders: "The parties are currently involved in settlement discussions and are hopeful of making progress. On that basis they have also agreed that the start of the trial should be deferred by 24 hours until 10.30 tomorrow."

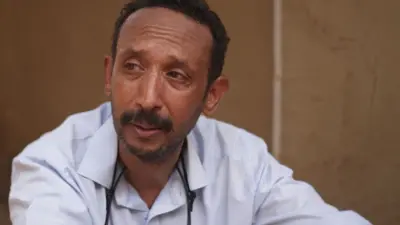

Image source, Getty Images

Mr Goodwin, who was stripped of his knighthood in 2012, oversaw the multi-billion-pound deal to buy Dutch rival ABN Amro at the height of the financial crisis in 2007, which led to the RBS bailout.

The case centres on the rights issue aimed at funding the deal, which asked existing shareholders to pump Β£12bn into the bank in exchange for discounted extra shares.

The bank and former directors deny any wrongdoing.

The bank has already settled the majority of claims over the issue, but has not admitted liability.

'Cloud cuckoo land'

The case is being heard by a High Court judge without a jury and will involve the remaining 9,000 individuals and 18 institutions. If they are successful, the final payment could be up to Β£700m if interest is added.

Mr Goodwin is due to be cross-examined on 8 June, the day of the general election. It will be the first time he has spoken about his role at RBS since 2009 when he told MPs on the Treasury select committee that he "could not be more sorry" for what had happened.

One shareholder, Stephen Allen, 67, from Sandy in Bedfordshire, said he believed investors were entitled to their day in court.

"My particular focus is on the non-executive directors as much as Fred Goodwin," he said. "I believe that these sorts of people take positions of responsibility on behalf of the shareholders ... and I believe the directors should carry the can."

Although Mr Allen felt the directors should face some sort of financial penalty, he added: "I know it's not going to happen. I'm not completely on cloud cuckoo land."

RBS has been loss-making ever since its Β£45.5bn bailout at the height of the crisis and remains 72% taxpayer-owned.

In February, the bank reported a Β£7bn annual loss for 2016.

The bank is also yet to settle with the US Department of Justice over claims it mis-sold toxic residential mortgage-backed securities.

In April, Chancellor Philip Hammond said the government was prepared to sell its stake at a loss.

Top Stories

More to explore

Most read

Content is not available