The video demonstration below will take you through the and show you how to navigate the upgraded Freelance Payment Portal.

Getting Started

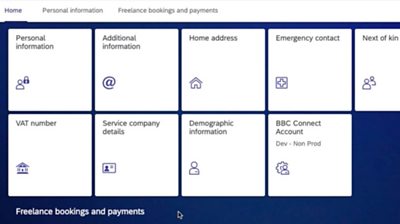

When you first use the Freelance Payment Portal you will see a section to review and update your personal information. Across the area are eight different tiles, not all will be required to be filled in. If you are not engaged via your Service Company or VAT registered there is no action required in these tiles. ALL freelancers must complete the diversity questionnaire.

Please note: Names, National Insurance Number, date of birth and email addresses cannot be updated here. You will need to contact ΒιΆΉΤΌΕΔ HR using this form to request the change. This information is used for identification & verification purposes.

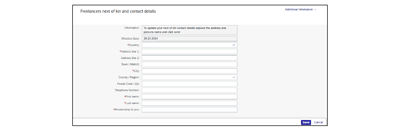

ΒιΆΉΤΌΕΔ Address

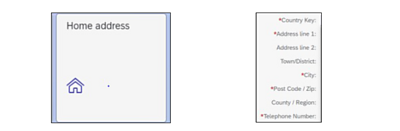

To update your home address select the βΒιΆΉΤΌΕΔ Addressβ tile and enter the information in the required fields marked with *.

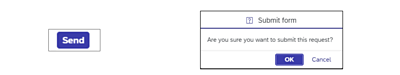

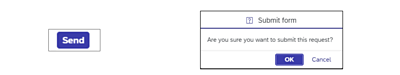

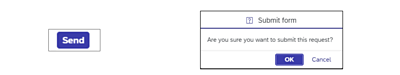

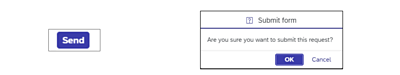

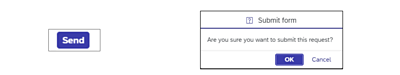

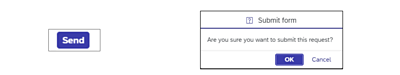

Press Send and select OK on the Submit Form pop up.

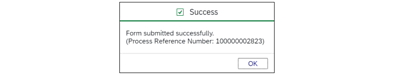

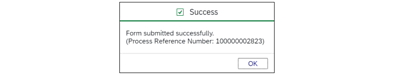

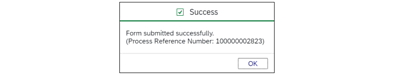

Select OK on the Reference Number pop up.

Emergency Contact

To update your emergency contact information select the Emergency Contact tile.

Enter the information in the required fields.

Press Send and select OK on the Submit Form pop up.

Select OK on the Reference Number pop up.

Next of Kin Details

To update your Next of Kin details select the Next of Kin tile.

Enter the information in the required fields.

Press Send and select OK on the Submit Form pop up.

Select OK on the Reference Number pop up.

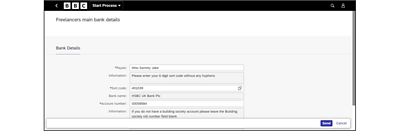

Bank Details (Main Account)

The first time you log onto the freelance payment you will be required to enter your bank details. If you need to change your bank details these will need to be changed before you claim any future payments.

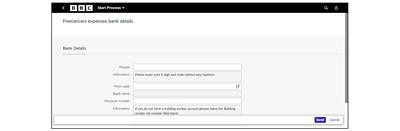

To update your bank details select the Bank Details (Main Account) tile.

Enter the information in the required fields. If you do not have a building society account please leave the Building Society roll number field blank. The following fields cannot be updated:

- Bank Name

- Payment Currency

These details will update automatically based on the sort code that is entered.

Press Send and select OK on the Submit Form pop up.

Select OK on the Reference Number pop up.

Bank Details (Expenses Account)

You only need to enter the bank details for expenses, if you require your expenses to go into a different account than your main one (above).

To update your bank details select the Bank Details (Expenses Account) tile.

Enter the information in the required fields.

Press Send and select OK on the Submit Form pop up.

Select OK on the Reference Number pop up.

VAT Number

If you are VAT registered and wish to claim VAT you must enter your VAT registration number.

Select the VAT Number tile.

Press Send and select OK on the Submit Form pop up.

Select OK on the Reference Number pop up.

Service Company Details

If you are operating through a limited company you will need to enter your service company address details.

To update Service Company details select the Service Company Details tile and enter the information in the required fields.

Press Send and select OK on the Submit Form pop up.

Select OK on the Reference Number pop up.

Remove Service Company Number

Select the Service Company Number tile.

Remove the number from the Service Company Number field.

Press Send and select OK on the Submit Form pop up.

Select OK on the Reference Number pop up.

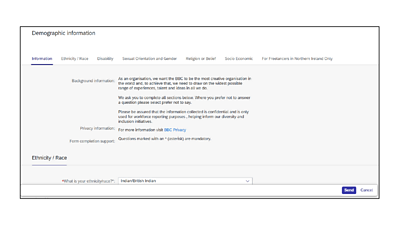

Demographic Information

Select the Demographic Information tile.

Complete the required fields in the Ethnicity/Race section.

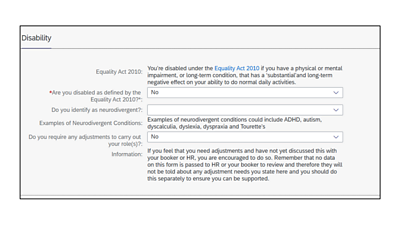

Complete the required fields in the Disability section.

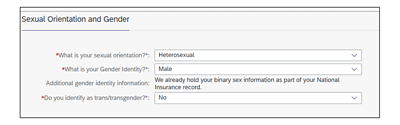

Complete the required fields in the Sexual Orientation and Gender section.

Complete the required fields in the Religion or Belief section.

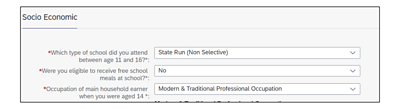

Complete the required fields in the Socio Economic section.

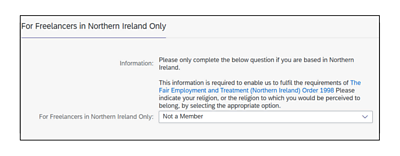

Only Freelancers based in Northern Ireland will need to complete the For freelancers in Northern Ireland section.